Why it’s time for Business Owners to Buy Electric Cars

From the 1st September, the new 70 registration plates have been released, as the DVLA makes a change to its car registration system.

This new system will see 2s and 7s in the number plate throughout the 2020 decade. It is a time that many business owners will be considering upgrading or changing their car. Up until recently, if you’d asked your accountant if you should buy a car through your business, the answer would almost always have been no, because the Benefit in Kind tax you would pay to run that car through your company would far outweigh any tax relief you got on the vehicle.

However, that all changed quite recently, and we are now in a position where, if you buy an electric car, then the benefit in kind tax is zero percent. And as anyone with even rudimentary maths can tell you, zero percent of anything is zero! Last month, I got to drive a Jaguar i-pace, Jaguar’s first all-electric model and winner of an incredible 62 awards, including an unprecedented treble of World Car of the Year Awards. It boasts the best part of 400 horsepower and some 513 lbs of torque, which means it can get from 0-60 in under 5 seconds with a top speed of just over 120 mph and has a range, albeit a little optimistic of around 250 miles per charge.

Watch our Top Gear style video to see how an electric car can save you £000’s in tax.

It’s an impressive machine, but what it even more impressive are the tax savings you can now benefit from by having a car like this in your business. The benefits of buying a car through your business are quite straightforward. You now get 100% of the cost of the car off set against your profits – on which you pay corporation tax.

Let’s go back to the i-pace; it is on the forecourt for around £65,000 and at that sale price equates to around £12,500 off your Corporation Tax bill. And, what’s more you get to drive one hell of a car. The Benefit in Kind Tax will stay at 0% until April 2021 but then will rise to only 1%, then 2% until 2024.

If that isn’t reason enough, then consider this; if you are currently funding your car privately, but using it for business, then the money you are using has already had tax deducted. If you are taking a salary or dividends out of your business then HMRC are charging you tax on those funds before you make any payments. But, now, if the company buys the car, then not only do you save all that good Corporation Tax relief on the price of the car, plus the running costs, but you also get to keep more of the money you do take out – because you aren’t funding the car – or you take less out in the first place, so pay less personal tax on it. Either way it’s a win, win.

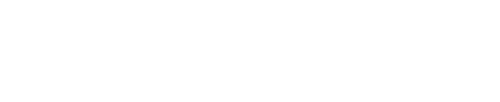

For a really good example of the savings you can now make, compare the tables below that show the monthly costs of the i-Pace (left) to a Jaguar f-Pace (right); a £40,000 diesel model of a lower spec.

If you are in the 40% personal tax bracket, it could be as much as £504 a month!

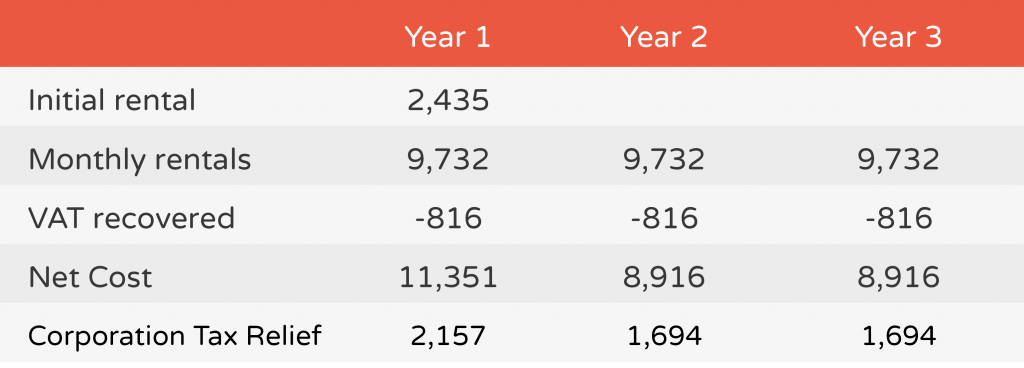

Or you could decide to lease the car, and make monthly payments but never actually own it and have to give it away at the end. If you choose this route you still get the tax relief on the lease payments, and also get to recover some VAT, (which you don’t do with the outright purchase) and the Benefit in Kind tax stays exactly the same. Using this route, the tax savings are significantly reduced, but you are laying out a lot less cash up front.

Over a three-year lease the tax relief looks something like this:

Now you might be thinking that this is all well and good, but you don’t have £65,000 to spend on a car, whether that is through the business or not. Well that is fair enough, I have used the i-Pace as an example, but in true BBC fashion, other electric cars are available. You can get one from around £25,000 and as long as it is new and electric then you can still benefit from all the tax savings!

If you are a business owner, who drives a car, and wants to save some tax, then you should seriously consider making your next vehicle an electric one and for the first time perhaps, do it through your business.

Get in touch

If you would like help with choosing the right car, we know lots of great places to start, but if you are interested in really saving some money, then give the top gear team at Cypher a call and we will be happy to help you out.